How CFOs use AI for better decision making and CSRD reporting

Volatility is no longer an exception. For CFOs, it has become the operating reality.

Commodity prices fluctuate monthly. Oil prices move markets. Regulation around sustainability and CSRD tightens. Geopolitical developments directly affect supply chains, margins and cash flow.

At the same time, regulators and audit committees expect clearer, more quantitative explanations of these impacts.

Most organisations are struggling not because information is missing, but because it is fragmented, late and disconnected from financial decision making.

This article explains how CFOs can use AI to turn geopolitics, sustainability and CSRD requirements into a controlled, monthly decision process, without creating additional reporting chaos.

The real challenge for CFOs is control, not information

When CFOs discuss geopolitics or sustainability, the conversation often becomes abstract. Yet the real issue is operational.

In many finance organisations:

-

external developments are discussed reactively.

-

financial impact is explained qualitatively rather than quantified.

-

actuals, forecasts and narrative do not fully align.

-

too much depends on individual effort during month end.

This creates risk. Not only for decision making, but also for credibility with regulators, boards and auditors.

The solution is not more reporting. The solution is structure.

What regulators and audit committees actually expect

Despite the complexity of CSRD and ESRS, expectations are surprisingly consistent.

Regulators and audit committees want:

-

specific risks and opportunities, not generic uncertainty.

-

clear links to revenue, EBITDA and cash flow.

-

consistency between internal management reporting and external disclosures.

-

documented judgement, ownership and audit trail.

Perfection is not required. Discipline is.

For CFOs and financial teams working on this, a line-by-line mapping of CSRD and ESRS disclosure requirements to finance processes can be downloaded here.

Download: CSRD/ESRS disclosure requirements mapping for CFOs

Treat external volatility like a financial close

High performing CFOs apply a familiar principle.

They treat external risk and sustainability the same way they treat revenue or cost control. As a recurring finance process.

The winning approach embeds external risk analysis into the monthly finance cycle instead of running a separate ESG or geopolitics process.

This approach rests on three pillars, which are fully described in the monthly AI-enabled external risk and market reporting framework.

Download: Monthly AI-enabled external risk and market reporting

Filter external noise before analysing impact

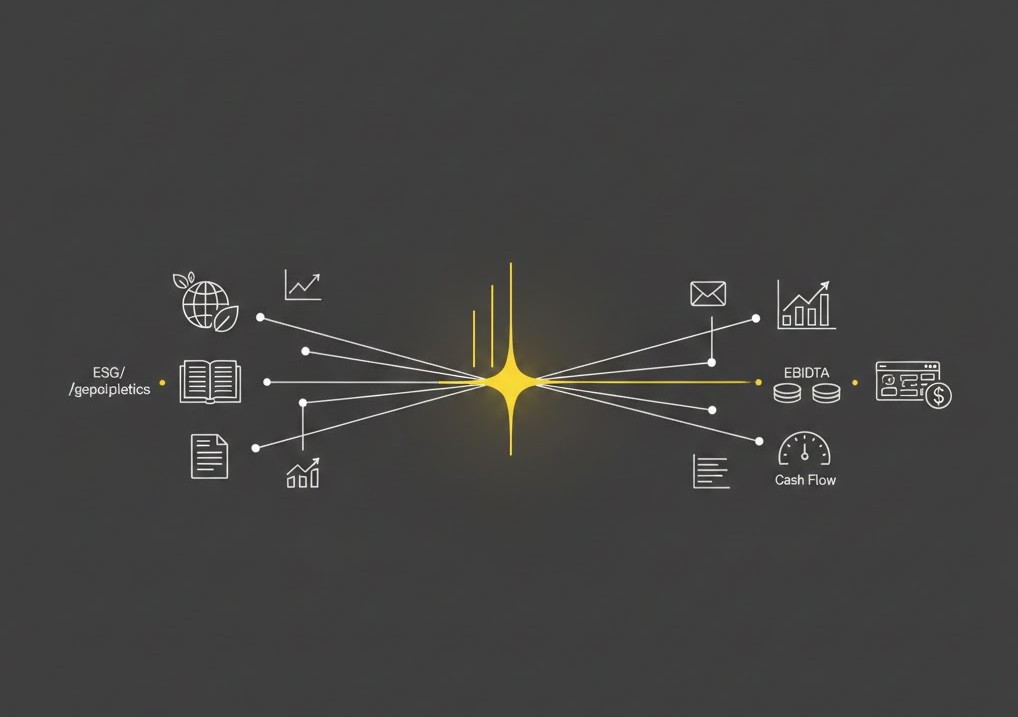

AI is exceptionally effective at scanning large volumes of external information.

It can monitor:

-

commodity markets such as plastics, paper and metals.

-

oil and energy price movements.

-

regulatory and geopolitical developments.

-

weather and infrastructure disruptions.

The key is discipline. AI filters and clusters information. Management decides what matters.

This avoids both blind spots and information overload.

For management teams, this filtering step is summarised in a concise MT-level external risk and market reporting format.

Download: MT external risk and market reporting

Translate external events into financial drivers

External developments only matter if they affect concrete drivers:

-

price

-

volume

-

cost

-

capex

-

compliance

Each relevant issue must be translated into forecast drivers and scenario assumptions. All changes must be logged, sourced and approved.

This step turns external news into financial control and is operationalised in a practical CFO toolkit for finance teams.

Download: Practical CFO toolkit

Maintain one version of the truth

Every month, management should receive a concise and consistent view:

-

a shortlist of 6 to 10 relevant external issues.

-

quantified EBITDA and cash impact.

-

a KPI snapshot reconciled to actuals.

-

scenario outcomes and sensitivities.

-

a documented assumption log.

There should be no parallel narratives and no separate sustainability numbers.

To ensure this discipline is applied consistently, controllers must be trained and certified.

Download: Controller training materials and certification checklist

Where AI adds value in the CFO function

Used correctly, AI improves speed, consistency and quality.

AI works well for:

-

daily scanning of external sources.

-

matching signals to the company footprint.

-

detecting anomalies in KPIs.

-

drafting first versions of narratives.

-

checking consistency between numbers and text.

AI should not:

-

change assumptions autonomously.

-

adjust forecasts.

-

replace management judgement.

-

approve disclosures.

In practice, AI functions as a very fast analyst. Accountability always remains with the CFO and finance leadership.

How this is governed, controlled and made audit-proof is described in the training-to-audit evidence pack.

Download: Training-to-audit evidence pack

A practical example from waste and recycling

In waste and recycling, external exposure is structural.

Oil prices influence virgin plastics and therefore recycled plastic margins. Commodity prices drive revenue per ton. Transport costs and emissions affect both margins and sustainability metrics.

By embedding these drivers into a monthly finance process, CFOs gain:

-

early visibility into margin pressure.

-

quantified downside scenarios.

-

clear linkage between sustainability KPIs and financial outcomes.

-

consistent input for board and audit committee discussions.

All without adding uncontrolled workload.

Why this matters strategically for CFOs

CFOs who industrialise this process gain three advantages.

First, better decisions. Management discussions become fact based rather than anecdotal.

Second, regulatory confidence. External disclosures are defensible and auditable.

Third, organisational calm. Fewer surprises, less firefighting, more predictability.

In volatile markets, control is a competitive advantage.

The CFO takeaway

AI will not make you a better CFO.

But a disciplined finance process, supported by AI, will.

The real question is not whether to use AI. It is whether you use it to reduce noise and strengthen control, or to create another layer of complexity.

The CFO role remains unchanged.

Turn uncertainty into structured decision making.